Index Investing: An active choice to choose passive

- EBnet Employee Benefits Network

- Jun 26, 2022

- 3 min read

Labelling index tracker funds as passive is a misnomer, says Nico Katzke, head of portfolio solutions at Satrix - SA’s first and leading index investment business. In fact, ‘passive’ investing is far from style agnostic, it can be actively tilted towards value, momentum, size and quality factors, often more consistently than active managers tracking the same index.

Katzke was speaking during a recent presentation at the 2021 BCI Digital Global Investment Conference, held virtually from 24-26 May 2021. “In theory, active managers should be tilting towards those factors that they believe will deliver outperformance. However, in reality, active managers often remain style neutral relative to their benchmark and fail to tilt consistently and successfully. As a result, active managers seldom outperform index trackers; and when they do, it is rarely repeated the next year.”

He said that, on a rolling three-year basis, the average rand actively invested in South Africa typically trailed the All Share and Capped SWIX indices, both of which are popular benchmarks and available to investors as index tracking ETFs.

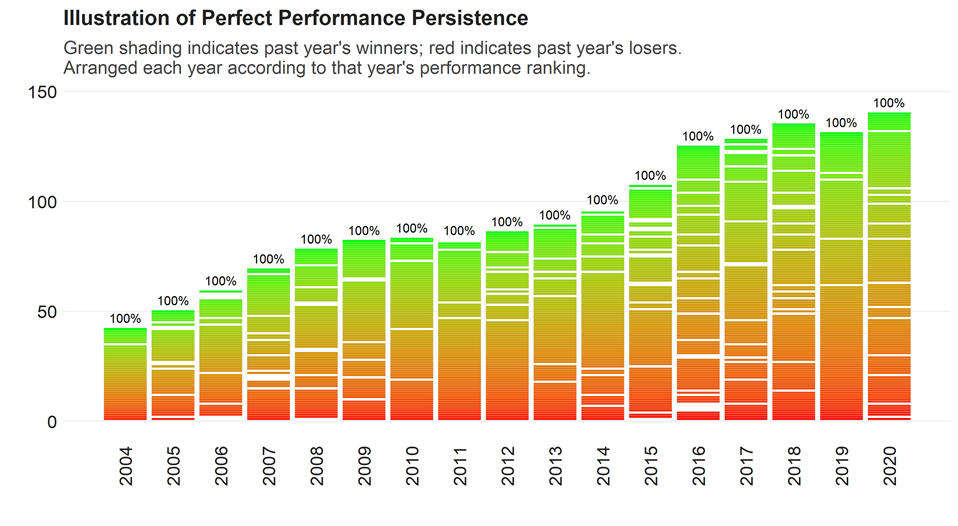

Additionally, active managers that manage to outperform these indices seldomly repeat this feat the next year. “Past performance has typically been a very poor predictor of future performance. While there was some consistency last year, with top ranked funds in 2019 generally performing well in 2020, this is an exception and not the rule. In the five years preceding that, you would have been better off picking the losers and holding on to them the following year. This speaks to how hard it is to beat the index and to remain consistent.”

Accounting for style tilts when evaluating investment manager performance emerged during the 1990s, says Katzke. “It became clear that outperformance was about more than beating inflation or market returns. To deliver true investment value, alpha had to be found by considering a range of systematic factors – ranging from price multiples and balance sheet quality to momentum and size – when making investment decisions. This has raised the bar for active managers, as the combination of market returns and academically verified style tilts, like favouring cheap, high quality companies with good momentum, has proven to be a strategy that delivers long term outperformance globally.”

He said tracker indices, like the All Share Index, are very active in terms of their style tilts. “Index trackers, or passive funds, often have consistent and strong style tilts. When comparing one passive fund to another, they often closely resemble actively managed funds.”

Katzke said a great example of active factor investing is Satrix’s SmartCoreTM. “This strategy considers a range of core factors that drive excess returns – such as the quality of the stock, its comparative value and the momentum of the sector. SmartCore combines the best of passive and active, consistently tilting towards these proven factors while maintaining the low-cost, rules-based construction investors have come to expect from passive funds.

“SmartCore has consistently outperformed the median of South African General Equity funds since inception, while outperforming its benchmark, the Capped SWIX, by more than 3% in annualized terms. We firmly believe, over the medium to long term, that SmartCore will continue to deliver clients market beating returns as these core factor premiums pay off.”

While an investor may conclude that picking a manager in one of the top performing funds is the best approach, the best managers very seldom remain the best managers over time. The below graphs demonstrate.

Graph one shows an illustrative scenario where active managers maintain their ranking over a 16-year period. The second graph shows the reality if you stack up active managers over the same period.

ENDS

Comments